ADA Price Prediction: How High Will ADA Go?

#ADA

- Critical Support Test: ADA's price is currently testing a major support level near $0.359, coinciding with the lower Bollinger Band. Holding this level is crucial for preventing a deeper decline.

- Technical Bearish Momentum: The price trading below the 20-day Moving Average and a bearish MACD crossover indicate short-term selling pressure that needs to be overcome for a trend reversal.

- Fundamental Catalysts for Growth: The development of Hydra for faster and more secure settlements on Cardano provides a fundamental bullish narrative that could support price recovery once technical conditions stabilize.

ADA Price Prediction

Technical Analysis: ADA Tests Critical Support Levels

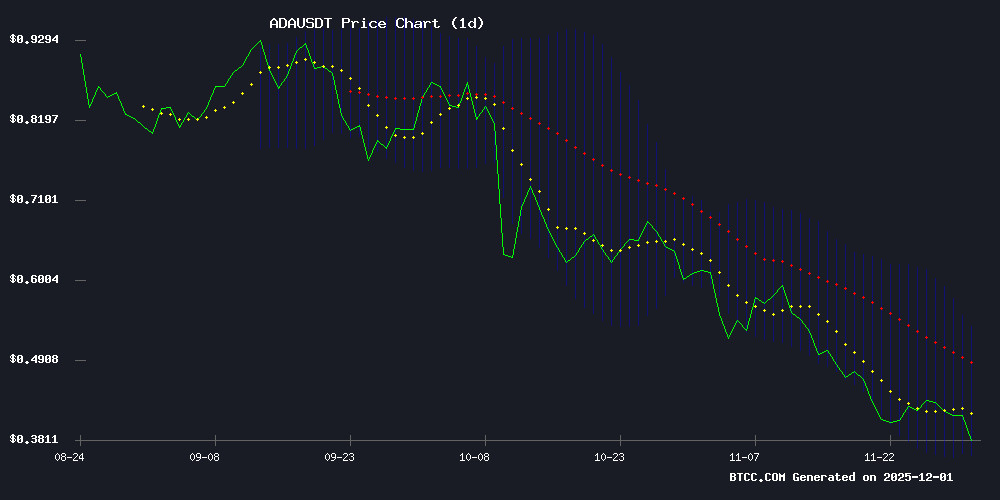

According to technical data for ADA/USDT as of December 2, 2025, the current price of $0.3763 sits below its 20-day moving average of $0.4483, indicating a short-term bearish trend. BTCC financial analyst Michael notes that the price is currently testing the lower Bollinger Band at $0.3595, which often acts as a dynamic support level. The MACD indicator shows a bearish crossover, with the MACD line at 0.0556 below the signal line at 0.0611, and a negative histogram reading of -0.0055. Michael suggests that a sustained hold above the $0.359 support could pave the way for a retest of the middle band NEAR $0.448, while a break below may trigger further declines.

Market Sentiment: Divergence with Emerging Bullish Catalysts

Market sentiment surrounding Cardano (ADA) presents a mix of caution and underlying optimism. Headlines highlight ADA testing critical support amid broader market divergence, which aligns with the current technical weakness. However, BTCC financial analyst Michael points to emerging bullish patterns and fundamental developments like the Hydra upgrade as potential positive catalysts. Hydra's promise of faster, transparent, and secure trade settlements could enhance Cardano's utility and long-term value proposition. Michael cautions that while near-term price action is challenging key supports, these developments may help foster a more constructive environment once market conditions stabilize.

Factors Influencing ADA’s Price

Cardano Price Prediction: ADA Tests Critical Support Amid Market Divergence

Cardano's ADA token hovers near $0.41, clinging to a multi-year ascending support line that has historically marked cycle bottoms. The current retest—its first since 2020—comes amid weakening market structure and sparse bid support, leaving traders divided between generational accumulation calls and warnings of a potential plunge to $0.30.

Technical charts reveal a precarious balance: while Sssebi's analysis highlights ADA's touchpoint with its historic trendline, Jesse Peralta's data suggests an intermediate support breakdown may already be underway. Volatility surges as the network's native token faces its most consequential price battle in four years.

Cardano Price Holds Key Support as Bullish Patterns Emerge

Cardano's ADA defends the $0.42 level despite broader market weakness, echoing its 2017 cycle low—a historically significant accumulation zone. The asset's current price action mirrors multi-cycle symmetry, a pattern that often precedes strategic institutional accumulation.

Technical structures reveal tightening bullish wedges across lower timeframes, suggesting potential energy for an upward breakout. Market sentiment remains divided, but the retest of generational support at $0.4167 presents a compelling risk-reward ratio for long-term holders.

While ADA shows 1.19% daily decline, its resilience at this level outperforms many altcoins. Analysts note that assets revisiting multi-year support bases tend to attract capital deployment from patient investors—especially when coupled with emerging chart patterns.

Hydra on Cardano Promises Faster, Transparent, and Secure Trade Settlements

Cardano's Hydra protocol is emerging as a transformative solution for high-frequency trading, offering real-time settlement without the inefficiencies of traditional intermediaries. By leveraging deterministic finality and Layer 1 anchoring, Hydra ensures transactions are globally auditable and immutable, addressing long-standing pain points in financial markets.

The protocol's financial-grade reliability reduces operational risk and friction, positioning it as a viable settlement layer for institutions like Wall Street and Nasdaq. Unlike conventional T+1 systems burdened by custodians and clearing houses, Hydra enables instant ownership transfer through cryptographic agreement within its "heads."

Industry experts highlight Hydra's potential to revolutionize market infrastructure. "What Wall Street considers instantaneous still involves multiple intermediaries creating operational drag," notes ADA analyst Dave. Hydra's architecture eliminates these bottlenecks entirely, establishing a new paradigm for deterministic settlement.

How High Will ADA Price Go?

Based on the current technical setup and market developments, BTCC financial analyst Michael provides a framework for ADA's potential trajectory. The immediate focus is on the critical support near $0.359. A successful defense of this level could initiate a recovery phase.

Potential Price Scenarios:

| Scenario | Condition | Near-Term Target | Key Resistance |

|---|---|---|---|

| Bullish Recovery | Hold above $0.359 support & positive market shift | Retest 20-Day MA (~$0.448) | Upper Bollinger Band (~$0.537) |

| Consolidation | Range-bound between $0.359 - $0.448 | Middle Bollinger Band ($0.448) | 20-Day MA ($0.448) |

| Bearish Breakdown | Sustained break below $0.359 | Search for next support | Previous support becomes resistance |

Michael emphasizes that for a more sustained move higher, ADA needs to reclaim the 20-day moving average around $0.448 to shift the short-term momentum. The upper Bollinger Band near $0.537 represents a significant technical hurdle. Fundamentally, the successful implementation and adoption of the Hydra upgrade could act as a catalyst to improve sentiment and drive demand beyond these technical levels in the medium to long term. The path will largely depend on whether the current support holds and if broader cryptocurrency market conditions improve.